Table of Contents

- SPY Stock Fund Price and Chart — AMEX:SPY — TradingView

- SPDR S&P 500 ETF TRUST Trade Ideas — AMEX:SPY — TradingView

- SPY Chart — SPDR S&P 500 ETF Trust — TradingView — India

- SPY Stock Price and Chart — AMEX:SPY — TradingView

- SPY - S&P 500 SPDR, Stock Quote, Analysis, Rating and News

- SPY Stock Price and Chart — TradingView

- Spy share price | ♥SPY Stock Fund Price and Chart — AMEX:SPY â ...

- SPY Stock Price Today (plus 9 insightful charts) • ETFvest

- SPY Stock Price and Chart — TradingView

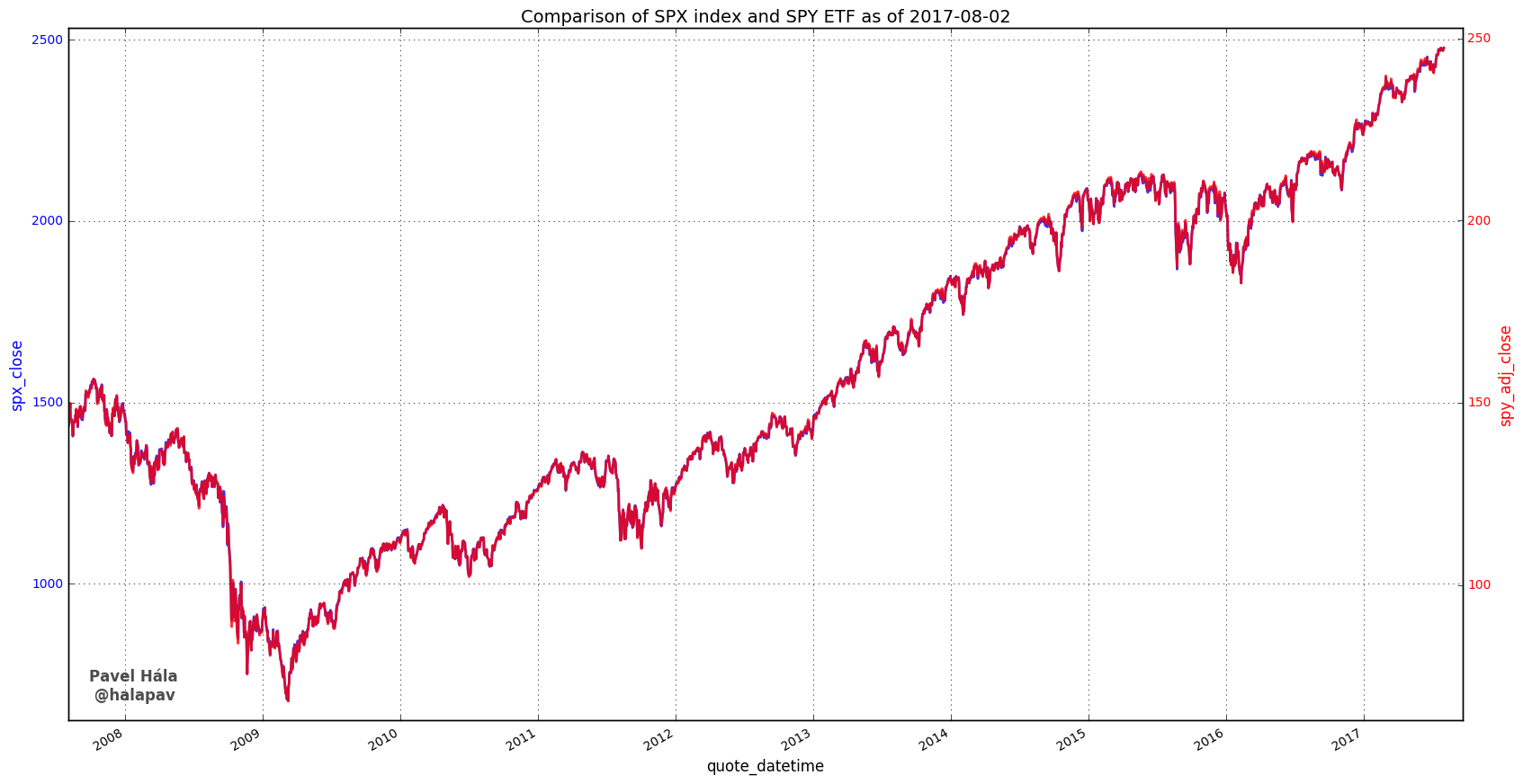

- A closer look at the SPY ETF | SpreadCharts.com

What is the SPDR S&P 500 ETF Trust?

Benefits of Investing in SPY

Risks and Considerations

While the SPDR S&P 500 ETF Trust offers many benefits, there are also risks and considerations to be aware of: Market Volatility: The value of the SPY ETF can fluctuate significantly, especially during times of market turmoil. This means that the value of your investment may decrease if the market declines. Tracking Error: Although the SPY ETF is designed to track the S&P 500 Index, there may be times when the fund's performance deviates from the index. This is known as tracking error.

How to Invest in SPY

Investing in the SPDR S&P 500 ETF Trust is relatively straightforward. You can buy shares through a brokerage account, such as Fidelity, Charles Schwab, or Vanguard. You can also invest through a financial advisor or online trading platform. In conclusion, the SPDR S&P 500 ETF Trust is a popular and widely traded ETF that provides investors with exposure to the US equity market. With its low costs, convenience, and flexibility, it's an attractive option for those looking to diversify their portfolio. However, it's essential to understand the risks and considerations involved and to do your research before investing. By adding the SPY ETF to your investment portfolio, you can potentially benefit from the long-term growth of the US stock market.For more information, visit MarketWatch to stay up-to-date on the latest news and trends affecting the SPDR S&P 500 ETF Trust.