As we approach the new year, investors are looking for opportunities to grow their portfolios and secure their financial futures. One often-overlooked but potentially lucrative option is Real Estate Investment Trusts (REITs). REITs allow individuals to invest in real estate without directly managing properties, providing a unique blend of income generation and diversification. In this article, we'll explore the top 10 REITs to buy for 2025, as identified by market trends and financial analysts.

What are REITs and Why Invest in Them?

REITs are companies that own or finance real estate properties and provide a way for individuals to invest in real estate without directly managing properties. They can offer a steady income stream through rental properties, mortgages, or other real estate-related investments. With the potential for long-term growth and income, REITs can be an attractive addition to any investment portfolio.

Top 10 REITs to Consider for 2025

Based on market performance, financial stability, and growth potential, here are the top 10 REITs to consider for 2025:

1.

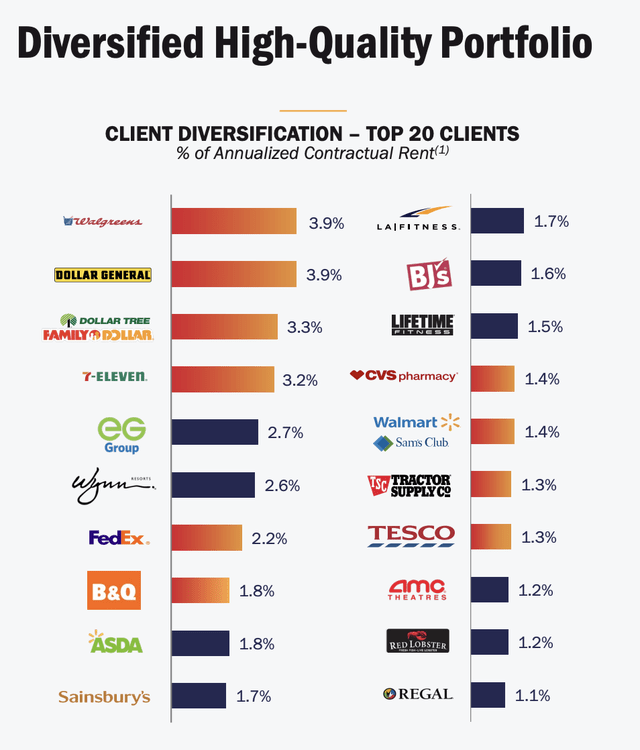

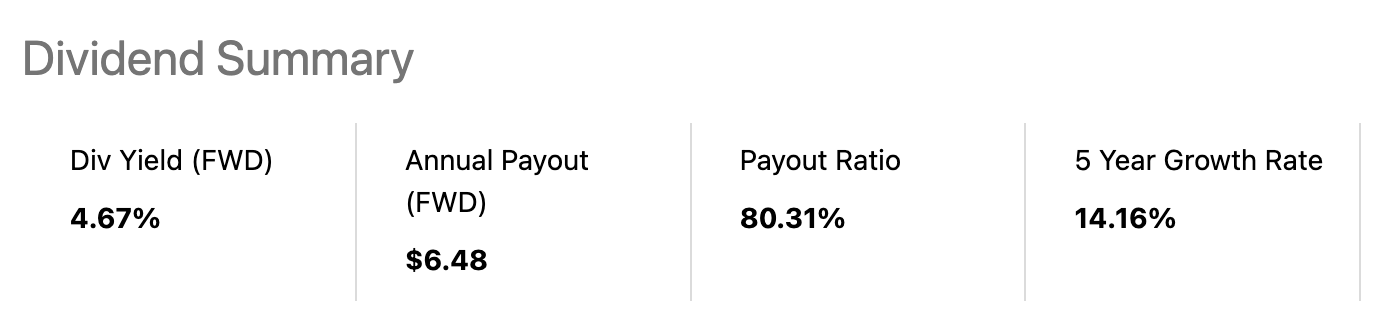

Realty Income (O): Known for its monthly dividend payments, Realty Income is a popular choice among income-seeking investors.

2.

Simon Property Group (SPG): As one of the largest shopping mall REITs, Simon Property Group offers a diversified portfolio of high-quality properties.

3.

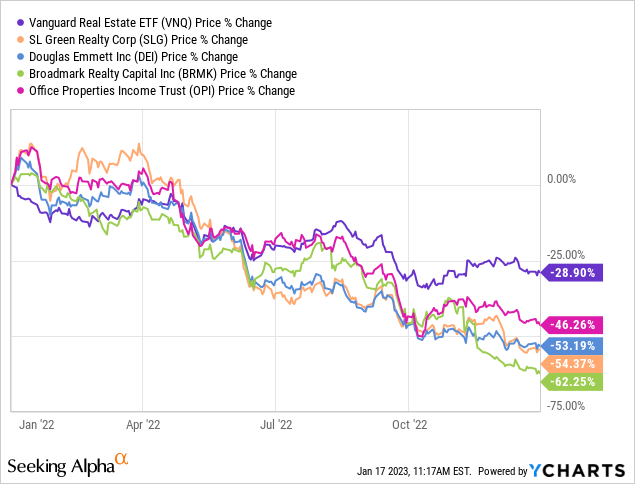

Vornado Realty Trust (VNO): With a focus on office and retail properties in major cities, Vornado Realty Trust is well-positioned for long-term growth.

4.

Welltower Inc. (WELL): As a leading healthcare REIT, Welltower Inc. offers a unique opportunity to invest in the growing healthcare industry.

5.

Duke Realty Corporation (DRE): With a diverse portfolio of industrial, office, and healthcare properties, Duke Realty Corporation is a solid choice for investors.

6.

Mid-America Apartment Communities (MAA): As a leading apartment REIT, Mid-America Apartment Communities offers a stable source of income and potential for growth.

7.

Equity Residential (EQR): With a focus on upscale apartment communities, Equity Residential is well-positioned for long-term success.

8.

Ventas, Inc. (VTR): As a leading healthcare REIT, Ventas, Inc. offers a unique opportunity to invest in the growing healthcare industry.

9.

Healthcare Trust of America (HTA): With a focus on medical office buildings and healthcare-related properties, Healthcare Trust of America is a solid choice for investors.

10.

National Retail Properties (NNN): As a leading retail REIT, National Retail Properties offers a stable source of income and potential for growth.

Investing in REITs can provide a unique opportunity for growth and income generation in 2025. By considering the top 10 REITs outlined above, investors can diversify their portfolios and potentially secure their financial futures. Whether you're a seasoned investor or just starting out, REITs are definitely worth considering as part of your overall investment strategy.

Remember to always do your own research and consult with a financial advisor before making any investment decisions. With the right information and a solid understanding of the market, you can make informed decisions and achieve your long-term financial goals.

This article is for informational purposes only and should not be considered as investment advice. Please consult with a financial advisor before making any investment decisions.