Are you struggling to meet the tax filing deadline? Don't worry, the Internal Revenue Service (IRS) has got you covered. With IRS Free File, you can easily file an extension and get an extra six months to submit your tax return. In this article, we will guide you through the process of filing an extension through IRS Free File and provide you with all the necessary information to make the most out of this service.

What is IRS Free File?

IRS Free File is a program offered by the IRS that allows eligible taxpayers to prepare and file their federal income tax returns for free. The program is available to individuals who earn $69,000 or less per year, and it provides access to free tax preparation software from leading tax preparation companies. With IRS Free File, you can prepare and file your tax return, as well as file an extension, all from the comfort of your own home.

Why File an Extension?

Filing an extension can be beneficial if you need more time to gather all the necessary documents, resolve any tax-related issues, or simply need more time to prepare your tax return. By filing an extension, you can avoid late filing penalties and interest on any taxes you owe. Additionally, filing an extension can give you extra time to contribute to a retirement account, such as an IRA, which can help reduce your taxable income.

How to File an Extension through IRS Free File

Filing an extension through IRS Free File is a straightforward process. Here are the steps you need to follow:

1.

Check your eligibility: Make sure you meet the eligibility requirements for IRS Free File, which include earning $69,000 or less per year.

2.

Visit the IRS website: Go to the IRS website at

www.irs.gov and click on the "Free File" tab.

3.

Choose a tax preparation software: Select a tax preparation software from one of the participating companies, such as TurboTax or H&R Block.

4.

Prepare your tax return: Use the tax preparation software to prepare your tax return, but do not submit it.

5.

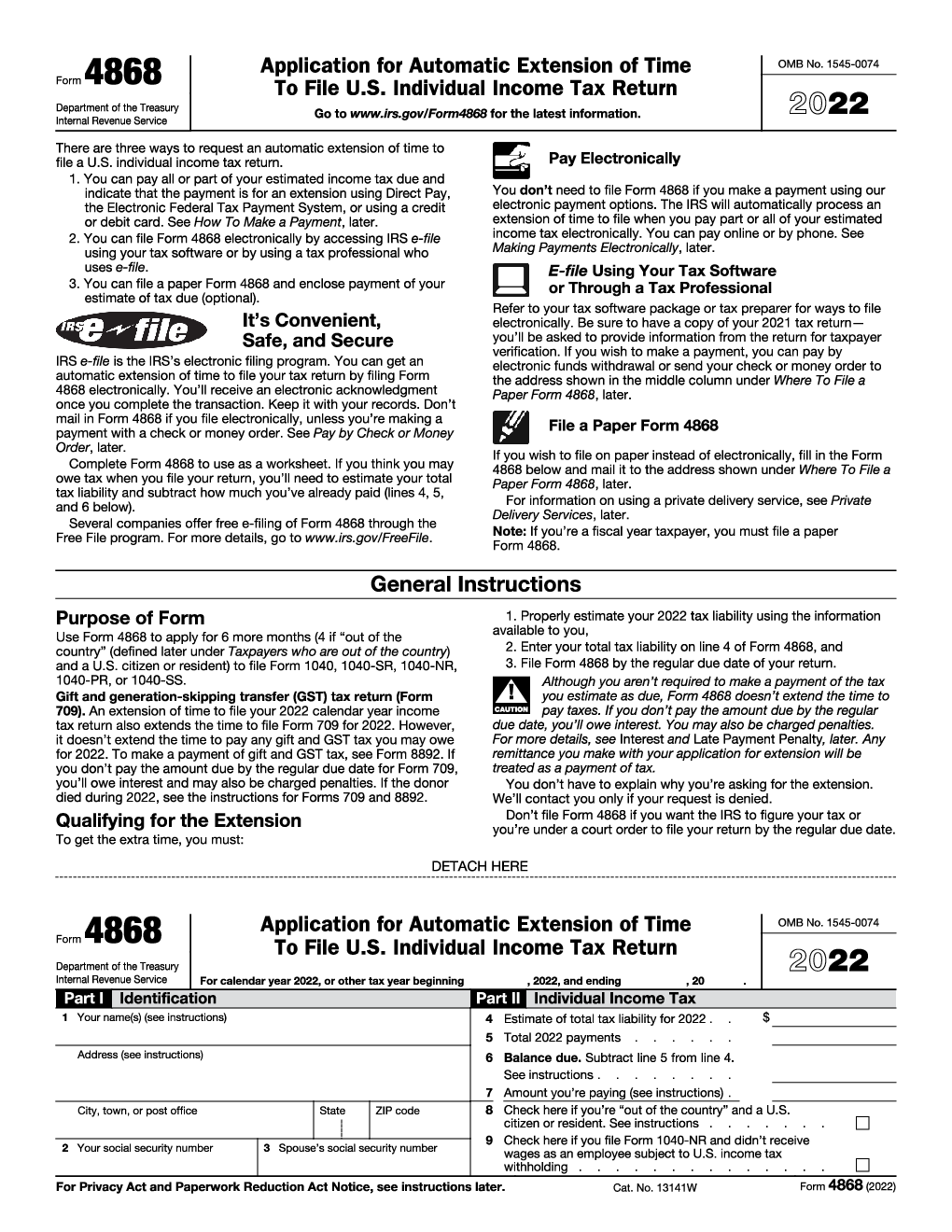

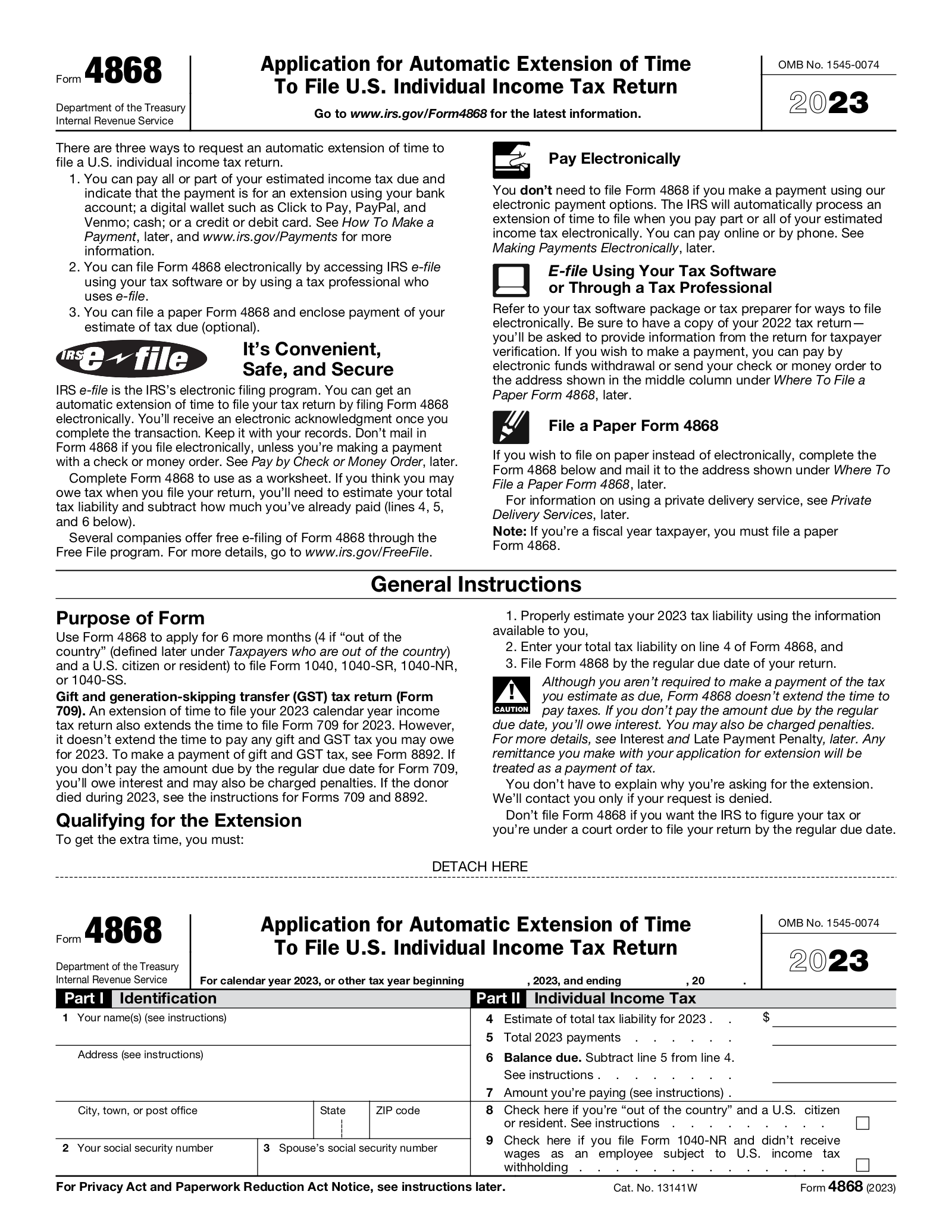

File Form 4868: File Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, which will give you an automatic six-month extension.

6.

Submit your extension: Submit your extension request through the tax preparation software, and you will receive a confirmation of receipt.

Benefits of Filing an Extension through IRS Free File

Filing an extension through IRS Free File has several benefits, including:

Free filing: Filing an extension through IRS Free File is free, which can save you money on tax preparation fees.

Convenience: You can file an extension from the comfort of your own home, 24/7.

Automatic extension: Filing Form 4868 will give you an automatic six-month extension, which can give you extra time to prepare your tax return.

In conclusion, filing an extension through IRS Free File is a convenient and free way to get an extra six months to submit your tax return. By following the steps outlined in this article, you can easily file an extension and avoid late filing penalties and interest. Don't wait until the last minute, file an extension today and take advantage of the benefits of IRS Free File.